No Guesswork Left: Tagged, Tested, and Tracked.

Join a journey built on discipline, resilience, and real-world performance.

Why Becoming a Full-Time Trader Is No Easy Feat. ↓

Markets

Selecting trading markets is challenging due to diverse asset types, unique market dynamics.

Strategies

Backtesting

Capital Management

Effective capital management in trading involves risk assessment, position sizing, diversification, consistent monitoring, and strategic allocation to maximize returns and minimize losses.

Risk Management

Effective risk management in trading involves setting stop-loss orders and limiting risk exposure to a specific percentage of total capital.

Setup Execution

Effective setup execution in trading entails precise entry and exit points, position sizing, market analysis, risk control, and timely order execution.

Stop-loss Placement

Stop-loss placement in trading ensures risk mitigation by determining predetermined exit points, limiting losses, and safeguarding trading capital. Always use a stoploss!

Risk to reward

Effective risk-to-reward ratio in trading involves evaluating potential profit versus loss, setting target gains, limiting losses, and optimizing trade outcomes to become profitable trader.

Trade Management

Trade management involves timely monitoring, adjusting stop-losses, setting profit targets, managing risk, and ensuring disciplined execution for optimal results

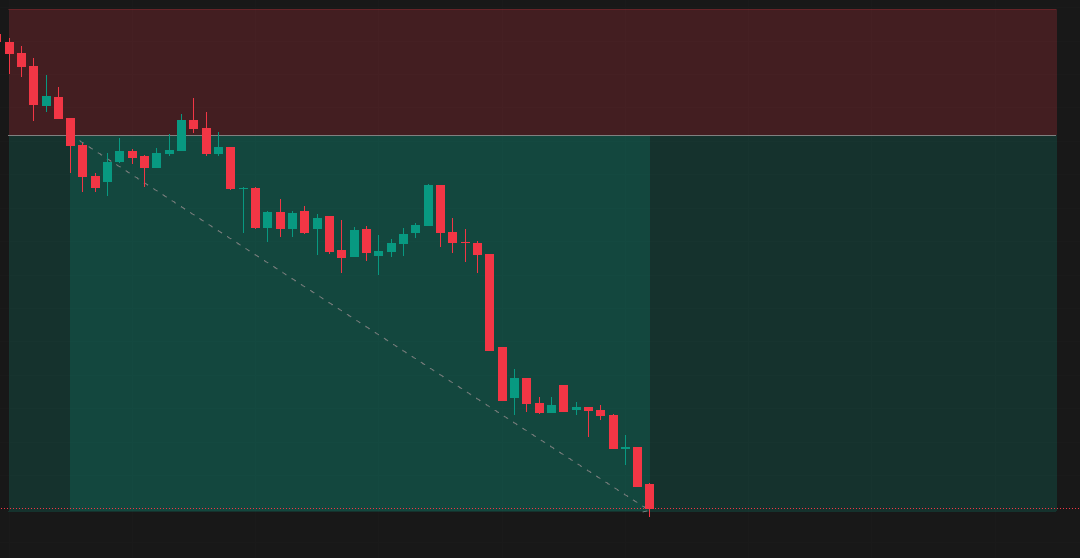

Losing Streak

A losing streak in trading involves consecutive losses, challenging a trader’s discipline, emotional control, and necessitating reevaluation of risk management

Psychological setback

A psychological setback in trading involves emotional strain, diminished confidence, stress management challenges, and the need for renewed focus and discipline.

Drawdowns

Drawdowns in trading represent the peak-to-trough decline in equity. It can lead to stress, eroded confidence, emotional trading, impaired judgment, burnout, fear, hesitation, and strategy tweaks.

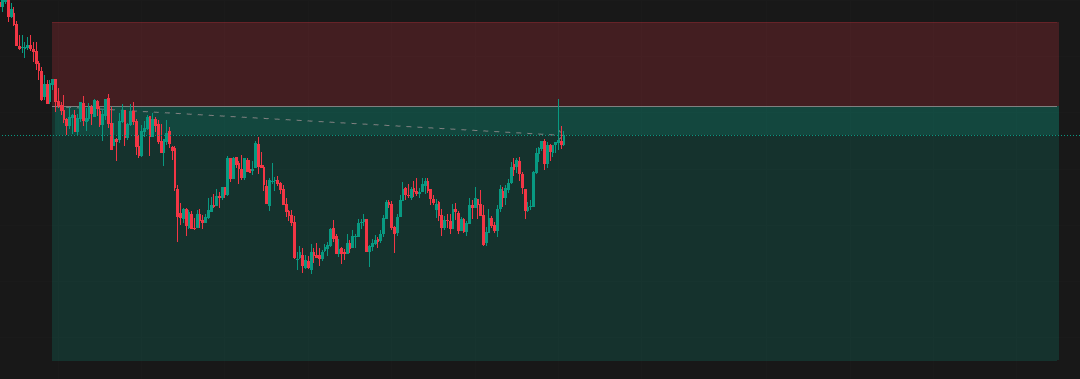

Recent Trades

Discipline Tracker: Health + Finance

CAPITAL ACCOUNT

Recent Posts

One Stop-Loss and One Breakeven: Intraday Options Trading Discipline in a Range-Bound Market

Today’s trading session was a reminder that following rules does not guarantee profits every day—but it does guarantee survival. I executed two...

Easy 3R Trade in a Choppy Market | Rule-Based Intraday Trading Journal

Today’s session was a classic example of how a rule-based system performs under uncertain market conditions. The market initially showed no clear...

Market Structure Changed After Entry | Intraday Trading Journal

Today’s session started with no clear directional commitment. Until the moment I entered my call short, the market leaned slightly downward — but...

Trading Discipline vs Family Time – New Year’s Eve Reflection

I hadn’t planned to trade today at all. It was New Year’s Eve here in Canberra, and my priority was clear — family time and the evening fireworks....